Today I would like to talk to you about two kinds of people in India. The first kind are the learned class, the intellectual types with good degrees and plush jobs, the kind you can find in offices around you. If you ask them- is India growing/getting richer/ on the right track? The first reaction would be a 😏.

If you probe them any further, they’ll tell you everything that is wrong with India. High inflation, joblessness, growing social tension, higher crude and commodities prices, rising inequality etc. This is the standard answer I generally get from most of my colleagues. And to prove their point, they’ll give you data and reports in droves, especially from the “reputed” international organisations and non-profits such as Amnesty, UNHRC etc.

What I generally ask after this is if they’re investing their money in stocks. More often than not, the answer is that hardly a part of their net worth is invested in equities. The two aren’t interrelated and am not drawing any conclusions but are just a reference point for further discussion.

On the other side are some people who are perma- bulls. Here’s a speech from Gautam Adani who said India is likely to eradicate poverty by 2050 and can have a $28-30 Trillion economy by then. A back of the hand calculation shows that it assumes an average growth rate of roughly 8% over the next 28 years. Here’s a link (https://twitter.com/ETNOWlive/status/1517145792594968578?t=Icdo1Qp89btcZdPUw1AmUQ&s=19)

The moment you tell these things to the first kind of people, you’ll be mocked, ridiculed and possibly shunned altogether. They are going to quote experts and organisations and who’s who or everywhere as to why India is never going to grow that large and why we’re not even growing right now and all the data published by the Govt which says we grew at 8% last year is a sham and what not.

Now here’s my take on this. If you ask them how many companies these experts run or have created? The answer is Zero. How many of such experts are self made millionaires, the answer remains to be zero. If you also ask them if any of their types even believed India was likely to survive the Covid pandemic, the answer still remains to be Zero. I call these experts Doomsday predictors. Fortunately, they don’t matter.

If you follow any of their advice, you’re most likely to never bet on India and will forever stay off from investing in the humongous wealth creation we’re likely to witness over the next generation. Choose your gods wisely.

Let’s talk about another idea. I’m reading this book about the performance of equities during the second world war.

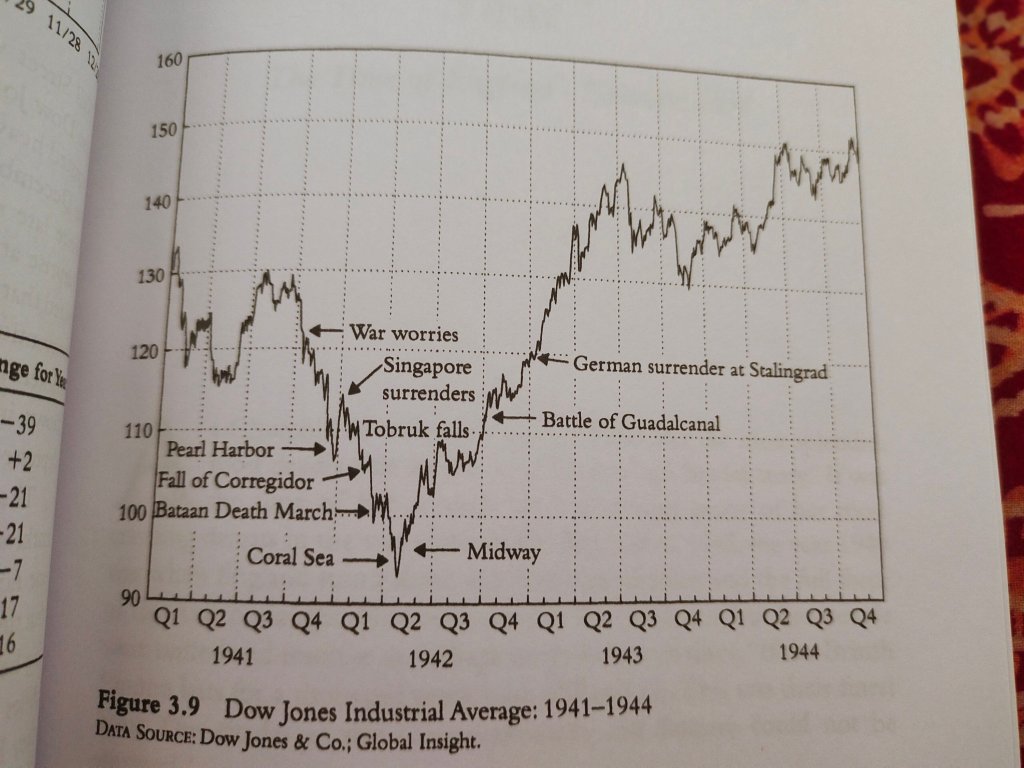

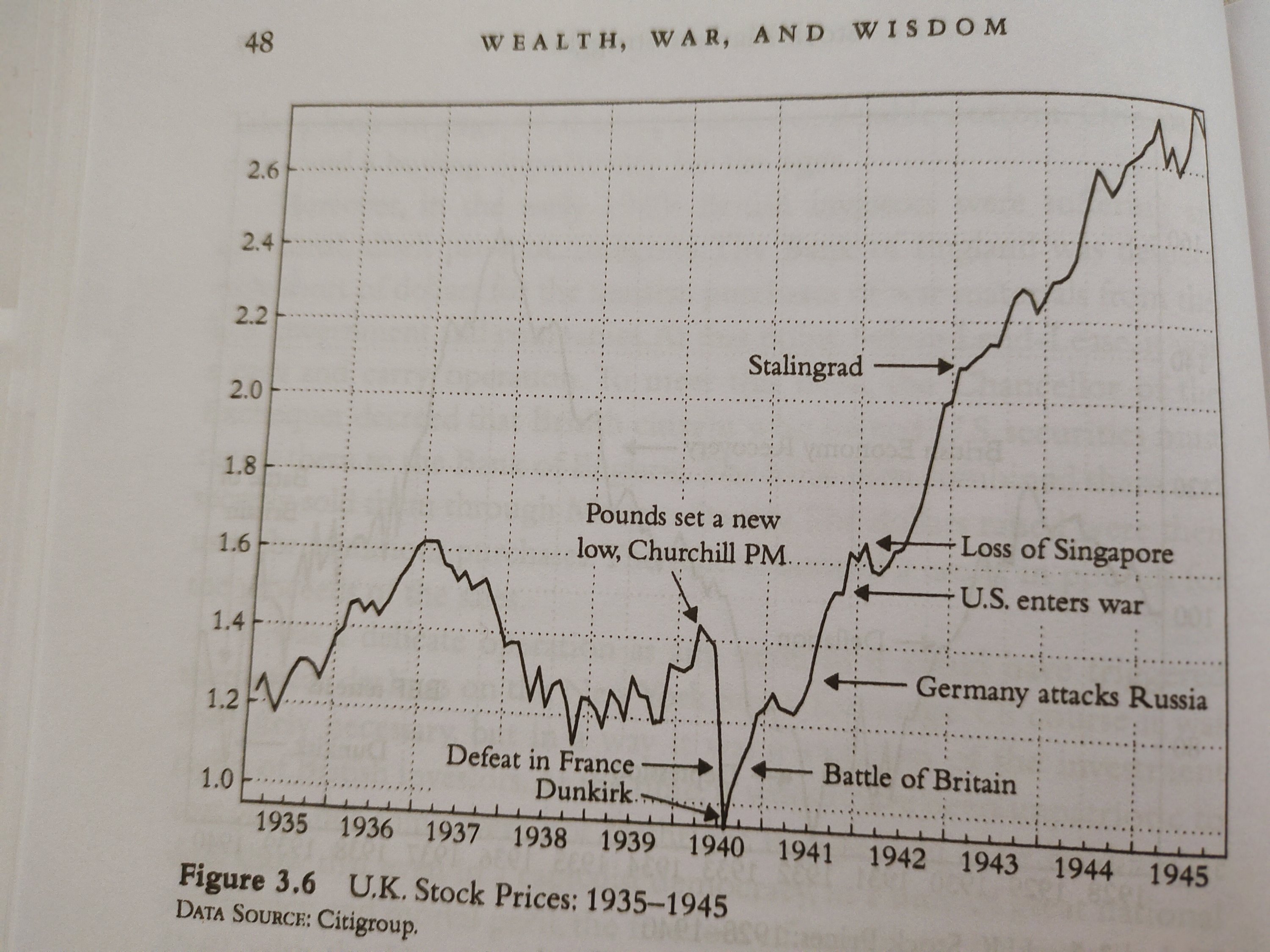

The most interesting thing which I took from this is that surprisingly, US, UK and German markets could sense which way the war was heading before even the generals and the political leaders knew. The UK market bottomed in 1940 when Britain was the weakest.The German market made its top much before their armies had even faced a significant retreat, much less a defeat and similarly the US market made its bottom when everyone knew that the US was losing the war. Take a look below:

The important takeaway is two: market bottoms are made at the point of maximum pessimism i.e. when you’re fearing apocalypse. After that, the market moves up not because the news is good or better but because it’s less bad than what is already known. Similarly, market tops are made at the point of extreme ebullience. Once that point is reached, it can only get worse from there.

It helps us understand why the market made its bottom on the day of the first lockdown in 2020 and not when the damage was done two months later. It also helps us understand why on February 24,2022, the recent panic low was made.

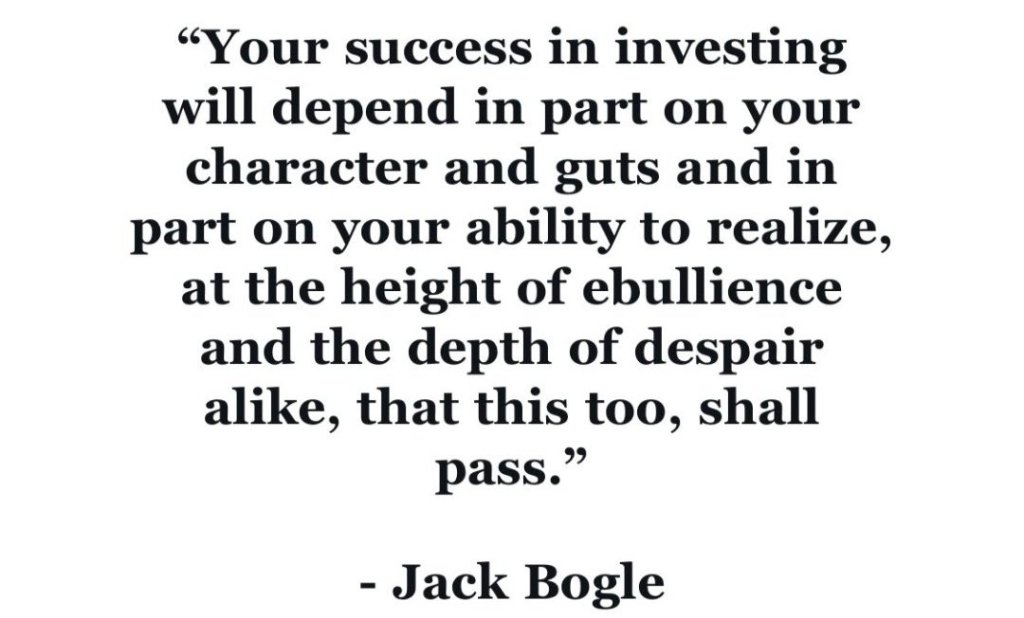

The point I’ve repeatedly made is to buy heavily when the markets fall and buy your heaviest when the world is collapsing. Here’s what Jack Bogle had to say

This sums it up the best!

PS: Since we are discussing experts, let’s also discuss the stock market gurus we watch on CNBC and on twitter. On April 4, when the merger of HDFC with HDFC Bank was announced, there hardly was anyone who didn’t go ga ga over the brilliance of the move. Every channel and its anchor and every expert worth his salt came out and said, the days of HDFC group’s underperformance are over and the upswing is just the beginning. They explained in detail how this will lead to low cost of funding and finally take the shareholders to the proverbial land of milk and honey.

Cut to yesterday, both the HDFC and HDFC Bank are down 15-20% from the merger day’s high. The same experts are now justifying why the merger isn’t that big a deal and why the group is likely to continue to under-perform over the next two years. So much for market genius!

Try watching this on YouTube by digging into the library of CNBC TV18 or just typing HDFC Bank merger news. It’s funny!