Every Bull Market is known for its legendary IPOs. It was Ford in 1950s, Reliance in 1970s, TCS and Maruti in 2000s and I believe it has to be NSE for the current mega run we’re in. No I don’t agree that this run will be known for pseudo-tech IPOs like Zomato or PB or Nykaa or even Paytm. It is most likely to be known for NSE as after a long time, one real cash generating machine is at the block for it’s debut. I’ve mixed opinions on whether or not I’m willing to subscribe to it’s offer and when in doubt, write! So here’s my two cents on NSE IPO.

First things first. It’s a fantastic company with one of the best balance sheets and cash flows we have in India. It mints over 5500cr revenue with almost 40% net margins and has what is certainly an almost unbelievable competitive advantage. It rules the roost in equity cash and derivatives market and the second largest player is quite a mile behind. So 1-0 for NSE.

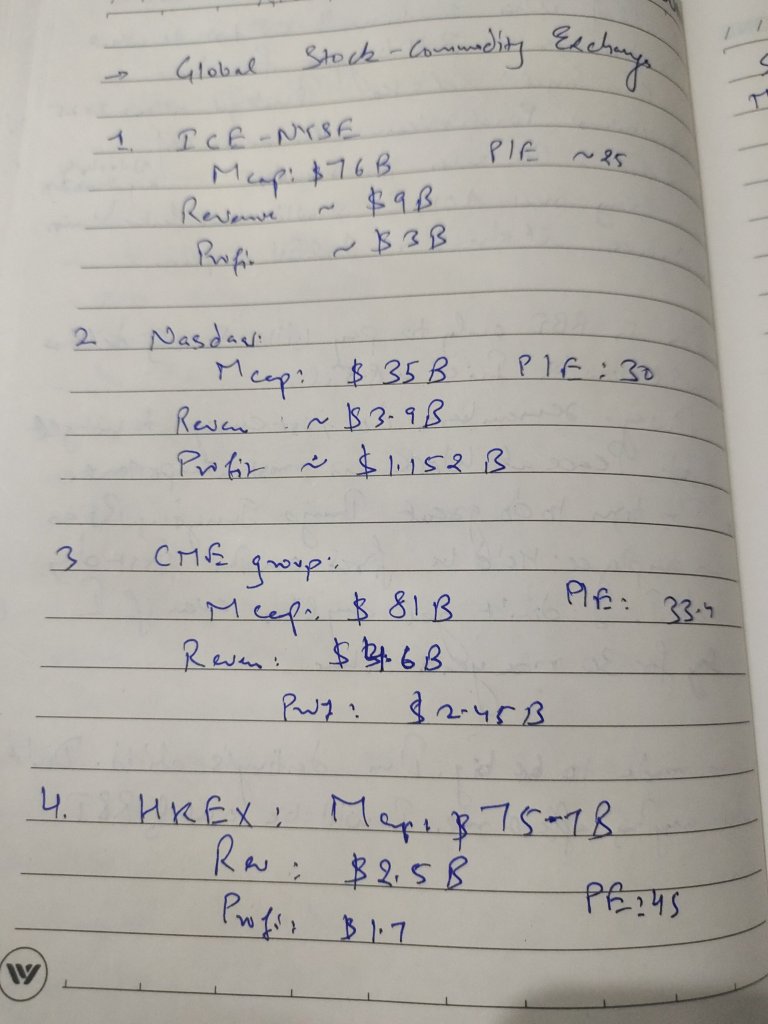

Second, let’s see what the IPO is about. It, according to market gossip, plans to list at about 2lakh crore valuations ( ~$26B ) which makes it one of the most valued stock exchanges in the world. I did a smll analysis comparing it to global peers and here is what I’ve found.

On the other hand, NSE has a revenue of almost $0.8B and net profit of ~0.4B. So at an asking market cap of $26B, it’s already the priciest of the lot. Our good old BSE is trading at ~$0.93B even at current price of 1560Rs. Now I’ll make some counter points to what I believe is the challenge and oppertunity of this issue.

The biggest stock exchanges of the world typically are valued at close to $80B with revenue between $3-9B and net profits between $1.5-3B. This for me is an upper ceiling of what NSE should be valued once Indian markets mature over the next 10-15 years as my thumb rule is that our financial markets are around 10-15 years if not more behind the US markets. So as they mature, with higher turnover and profits, NSE should make close to $5B revenue and $2.5B in order to be valued at around $75-100B and this I believe should take 10 years if not more.

Now my problem is that too much growth is being priced in to perfection at this price. For NSE to generate $5B in revenue, i.e. almost 6x revenue, even at 20-25% revenue growth rate, it will take atleast 8-10 years. So in that case, if everything turns out to be true, NSE will definitely be an unbelievable money machine and should see its market cap at close to where NYSE/CME are today. So this means if it lists at close to $26B, it should be 3x in 10 years in a most optimistic scenario.

However,What we experience in Indian economy is that there are hardly any companies above $2B revenue, which generate that kind of growth rate. So I believe I assume safely that NSE shares should be trading at over 12000rs in ten years(assuming IPO at 4000rs)

Now let’s do what Charlie Munger does best- invert. NSE is ten times BSE in revenue and 15-20x in profits( this being an unusual good year as NSE sold CAMS) And it trades at close to 30x it’s market cap. So going by the logic that BSE will also slowly grow it’s turnover and profits normally, if NSE does go to $75B market cap with $5B revenue, BSE would also be making close to $500m, and since costs catch up slower, net profits should be close to $200m. So even at current PE of ~38/40, BSE should be valued at around $8B. This means BSE should be trading at, voila, a share price of, you guess what- 13333Rs.

Yes, that’s right. If only nothing speical happens and BSE still remain a lousy exchange it is made out to be, it’s share price should be almost 9x from here in ten years, just to play catch up to NSE valuations and market sentiments.

I hope you know what I mean!