So most of my friends have been making a ton of money in metal stocks, which we had picked during the crash of 2020. This metal rally has been termed variously as the Super-cycle, Great Metal Run etc. The point I am arguing is a bit contrary- this might be a good time to sell out!

That the price of all metals- ferrous and non ferrous have rallied to all time highs is known to all. Good quality firms- TataSteel, JSW, Hindalco are hitting life highs while plain bogus, garbage companies such as HindCopper, SAIL have risen to stratosphere.

NALCO, my contention is,has some 20rs upside left- however, I must admit that once a rally starts, calling the top or predicting it’s bottom is impossible. It can double from here, crossing it’s earlier life high and go up further- please remember : There’s no top to a bull market and no bottom in a bear.

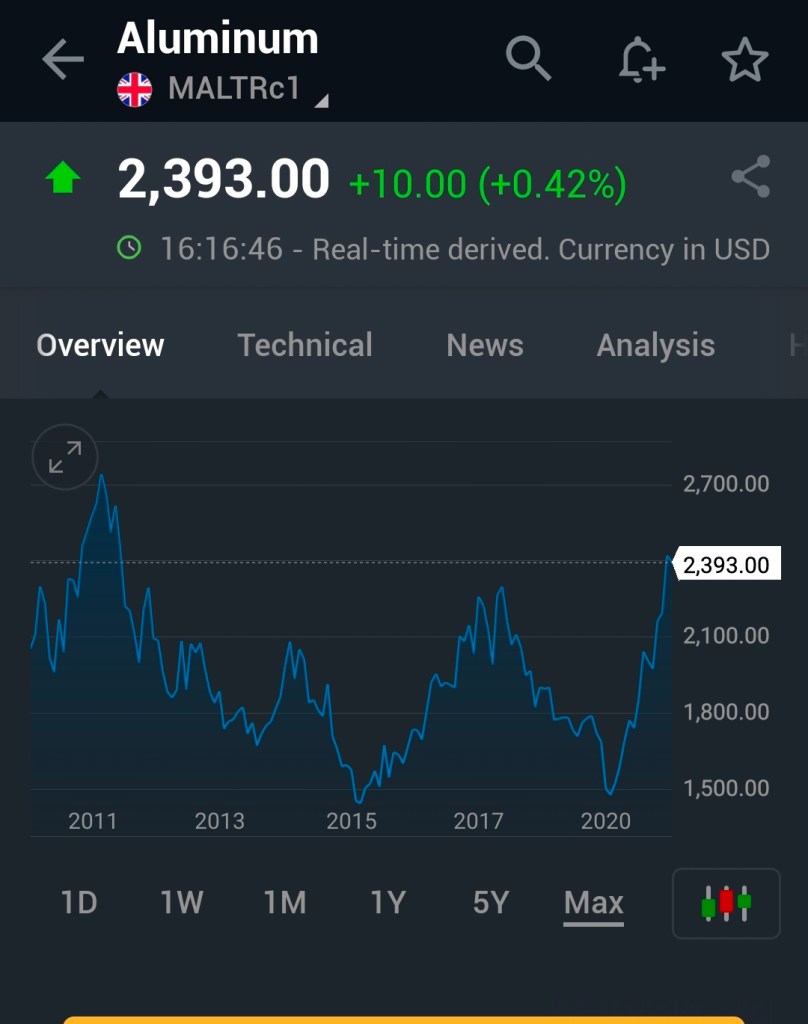

Just a cursory look at the two charts below will tell you that the two charts are similar, if not plain congruent. Share price of NALCO moves in tandem with price of aluminium and there is no rocket science. So by drawing a straight line between today’s aluminium price and checking 2011, which was when it hit this price the last time, we can quickly figure out that NALCO should be close to 100rs if LME Aluminium stays at this level. There is no more, no less maths to this

However, here is why I am saying it’s time to get out, atleast in parts. You never buy at the absolute bottom and can never sell at the absolute top. So most of us who have doubled their money or more, must realise that it’s under two year’s time that the money has doubled- cagr of close to 70% plus. This is insane and must be celebrated with abundant caution. Be proud of the fact that we bought it at 30rs when nobody wanted to touch it and we’re brave enough to hold it through. So pat yourself on the back and book some of it now.

There are proponents of a consistent upswing who say this will last two years or five years or what not. Basically that’s all nonsense. These so called big guys basically chase momentum and nothing more. They buy the most fancy stuff and intellectualise it. Like the most recent fancy of chemical stocks. I am a Chemical Engineer by training. I still remember that no chemical engineer wanted to work for these chemical companies for it’s a dud business. This is nothing but the sugar rally of 2010s . I find it funny that as a chemical engineer and someone who wrote UPSC with chemistry optional, I can’t understand half the names of chemicals NavinFlourine or Alkyl Amines or SRF makes, but these commerce graduates on CNBC preach the prowess of 2-benzene-3alkylnitrophosphate.

Similarly, we all know that the price of aluminium is rising because of current tensions between Australia and China. So if you can predict that when the two countries are going to announce a truce and you will be able to sell a day prior to that or that China will go to war and the price will rise forever, I think you are smoking a lot of hash. The simple answer to this question is- I don’t know and Nobody know.

There is a difference between cyclical stocks and secular stocks. The money in cyclicals s made by buying early and at bottom and selling at fairly high and also, early. The famous Barron of Rothschild said- fortunes are made by buying low and selling early. I guess I should be out of it over the next week or so, when the music is still on and people are dancing. I will get out when people are still coming in, not when there’s a stampede on its way out.